Dillon’s Blog August 2022

Written by:

Date:

Is the pipette half full or half empty?

Putting the recent biotech and life sciences downturn into perspective, and how external partnerships can help be part of the solution

You don’t need a Ph.D. in economics to appreciate that 2022 has been a rough year for biotechs, big pharma and, more recently, life sciences companies. These once high-flying industries are suddenly cash strapped and shedding employees at dizzying rates. Experts suggest that this is due largely to a market correction that’s adjusting for the exuberant investment made by retail investors during the post-COVID vaccine bull run of 2020 and part of 2021. And although companies with commercial-stage assets fared best during this most recent period, they weren’t completely immune to the downturn.

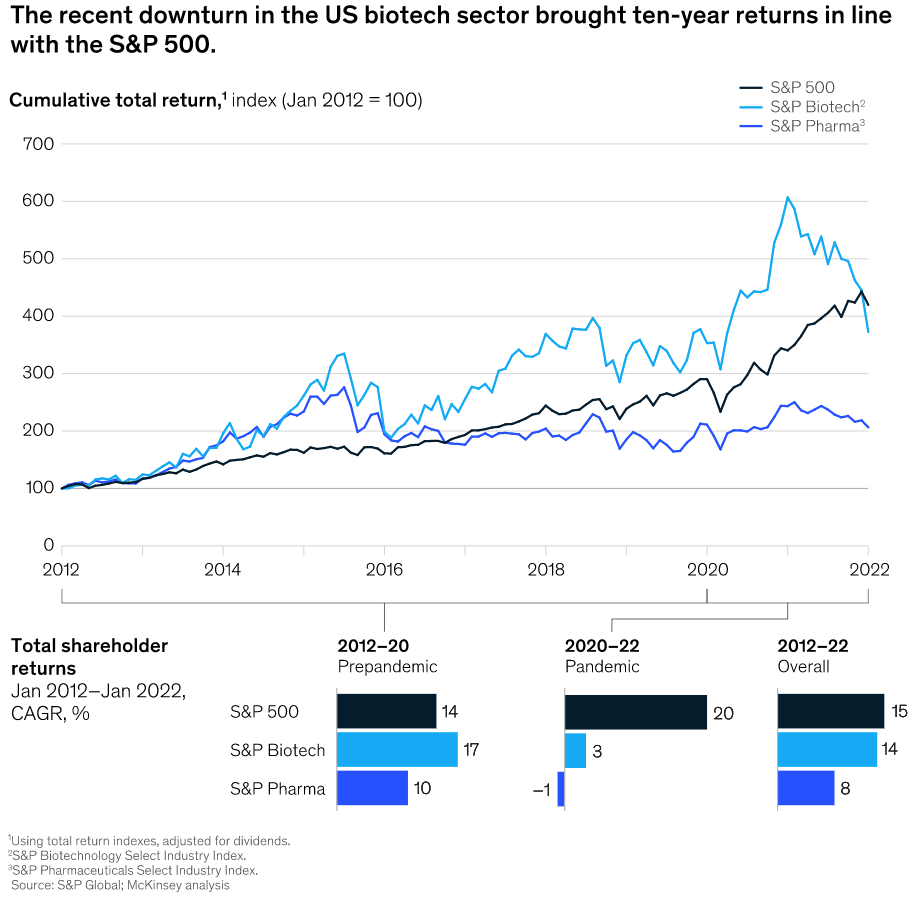

The sky is not falling, however. A recent McKinsey paper provides some useful, and reassuring, data to suggest that the industry has weathered similar downturns in the past. According to the report: “Over the past decade, biotech stocks have soared far above the S&P 500 a number of times, only to fall back to market level [Exhibit 1]. Investors have repeatedly exulted in biotech’s limitless potential, then shunned the stocks after late-stage assets imploded, and finally rushed back in when breakthrough products proved to be game changers. Even including the recent rout, the S&P biotech index has delivered ten-year returns comparable to those of the S&P 500 and higher than those of the S&P pharmaceuticals index.”

So what does that mean for HDMZ, and the role we can play to help our clients thrive in this environment?

The same McKinsey paper provides some practical paths to recovery for these sectors or any business, for that matter, marked by higher scrutiny on costs and exploration of new value creation. While the knee-jerk reaction may be to reduce investment in external partners and agency support, the paper actually encourages the opposite and states: “Capital constraints should spur a reevaluation of partnerships across the value chain … [and] any partnership that expands capabilities, accelerates development timelines, or de-risks assets can create value.”

Agencies willing and able to deliver creative thinking, practical investment recommendations and innovative ways to engage patients, HCPs and other stakeholders through clinical development and commercialization, can help to catalyze a rebound for the industry that history suggests will happen. And while that’s easier said than done, there are other small, but meaningful, actions we can take every day. One is to embrace empathy, which just happens to be an HDMZ core value.

The ability to see things from another person’s perspective not only makes you a more effective communicator, but also a better colleague and partner. Understand the pressures our clients are under every day from their stakeholders. Do everything in your power to generate value – both small and large – with every interaction. And, most importantly, appreciate the opportunity we have to participate in what Barbara Ryan, senior adviser of life sciences at the consulting firm Ernst & Young refers to as an “innovation renaissance.”

Written by

You may also like

All rights reserved Privacy Policy